Pathway is a private market specialist targeting attractive risk-adjusted returns across the private market spectrum.

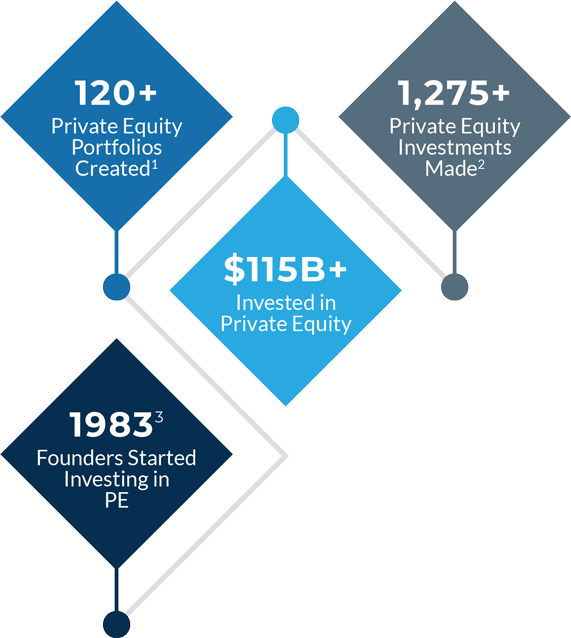

PRIVATE EQUITY

With more than 30 years of experience as a leading global investor in private equity, Pathway is dedicated to identifying and investing in the highest-quality opportunities.

Buyouts

Venture Capital

Growth and Opportunistic

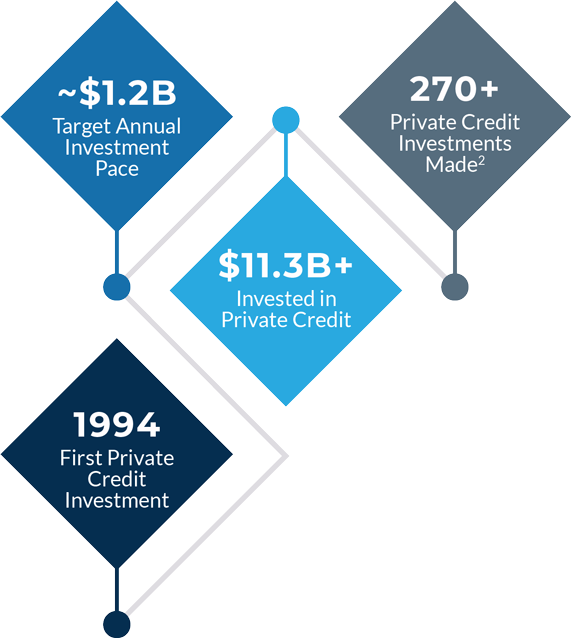

PRIVATE CREDIT

Pathway is a global investor in private credit, focused on outperforming public credit indices by investing selectively across the private credit spectrum.

Direct Lending

Mezzanine

Distressed Debt

Specialty Lending

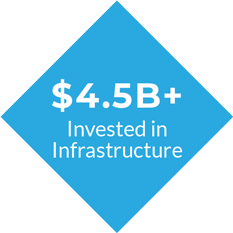

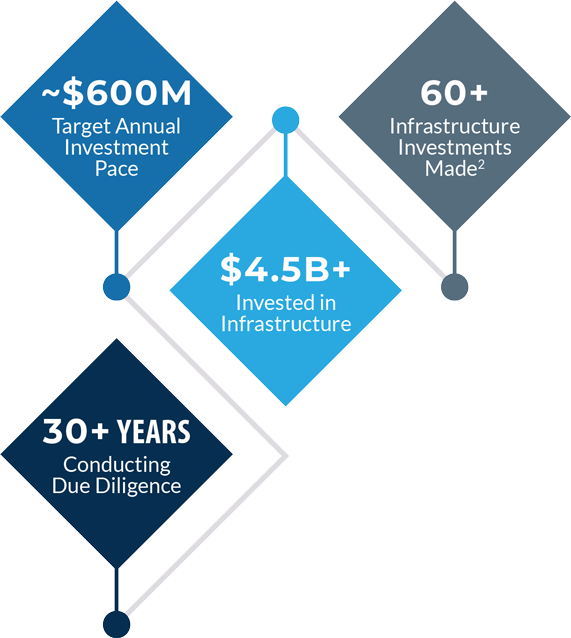

INFRASTRUCTURE

Pathway seeks attractive risk-adjusted returns from a diverse portfolio of assets that possess inflation protection, high capital preservation, and low correlation to other assets.

Core

Public Private Partnerships

Core-Plus/Value-Add

Opportunistic

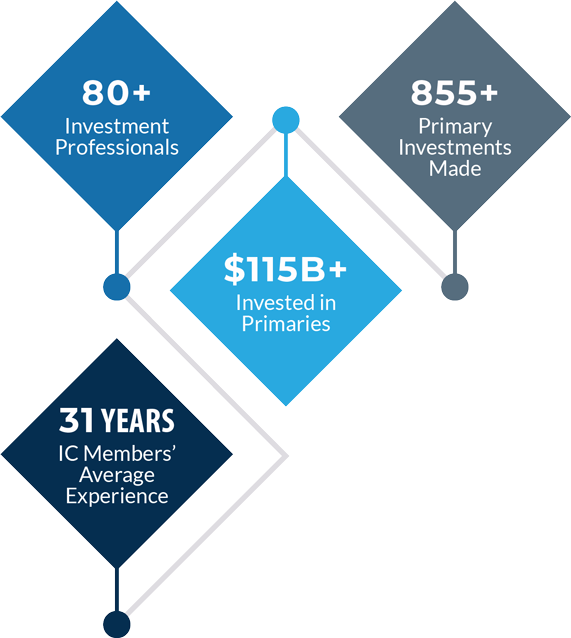

PRIMARIES

Pathway’s deep and long-standing relationships, scale and credibility, and proactive-sourcing efforts are designed to help Pathway gain meaningful access to high-quality fund opportunities.

Private Equity

Private Credit

Infrastructure

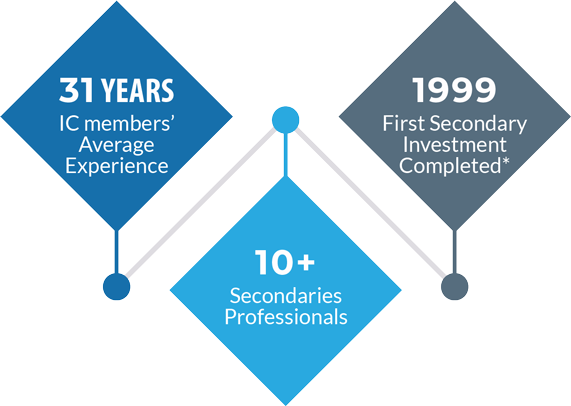

SECONDARIES

Pathway is an active participant in the secondary market, utilizing its private market experience, reputation, and market insights to invest in funds managed by high-quality managers worldwide.

Private Equity

Private Credit

Infrastructure

*Non-discretionary investment

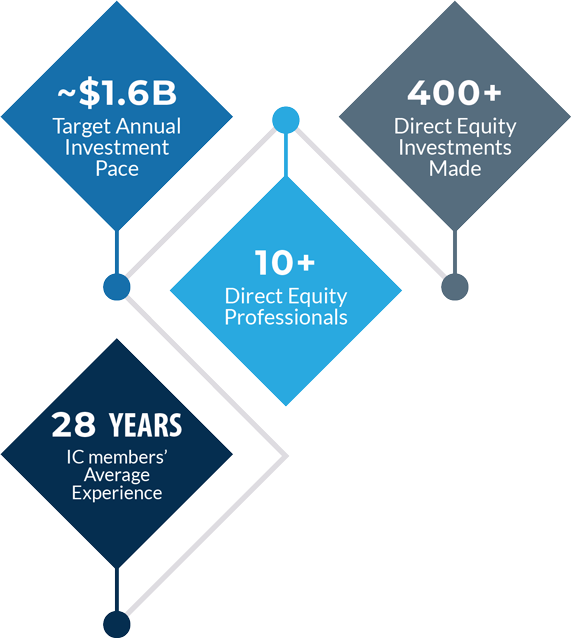

DIRECT EQUITIES

Pathway seeks to leverage its deep and long-standing network of manager relationships in an effort to source high-quality direct equity investments at attractive economics.

Private Equity

Infrastructure

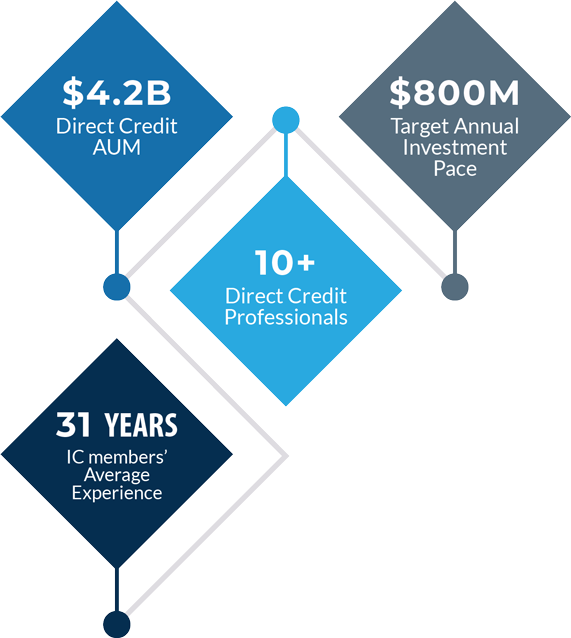

Direct Credits

Pathway leverages its longstanding relationships with

leading private equity firms to source attractive debt financing opportunities.

First Lien

Unitranche

Second Lien

Mezzanine

1. Comprises portfolios for discretionary and non-discretionary client relationships that have the primary objective of achieving returns commensurate with the returns of the private equity asset class as determined by Pathway. Includes primarily private equity fund investments and direct equities, but may also include some investments that overlap between private equity and other strategies (such as private credit).

2. Private Credit Investments made, including primaries, secondaries, and direct credits.

3. Represents founders’ experience prior to founding Pathway in 1991.