We believe private market success requires access to top-tier GPs, deal flow, data, and insights, which Pathway has been delivering for 30+ years.

Providing Access to RIA/HNW Investors alongside Our Institutional Clients

With more than $90 billion in assets under management and more than 30 years of experience making private market investments, Pathway is a leading partner for accessing the private markets.

We seek to identify the best GPs in the private markets and to invest alongside them across primary, secondary, direct equity, credit, and infrastructure investments to deliver strong returns and an exceptional experience for our clients.

Why Private Equity?

Private equity has historically proved to be the highest-returning asset class within the capital markets.

Today, more companies are staying private longer, which means greater wealth creation in the private markets vs. public because companies are going public at much higher valuations.

Source: LINQTO article “Why are Companies Staying Private Longer: Expert Analysis on This Growing Trend June 2024.”

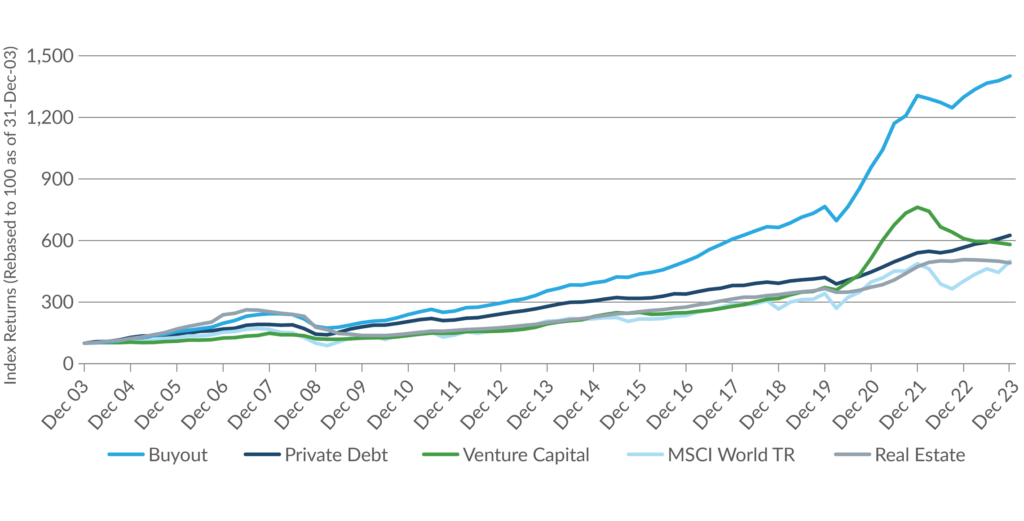

Private Capital Quarterly Index

Source: Preqin Private Capital Quarterly Index Chart March 2024.

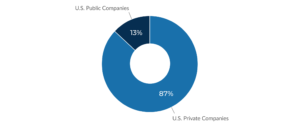

The vast majority of U.S. companies generating revenues exceeding $100 million are privately held.

Due to the lack of public information inherent in the private markets, GPs have the ability to gain an informational edge when taking ownership control of private companies. This creates an opportunity for them to grow revenues, improve margins, and increase the enterprise value of these businesses.

Private Company Opportunity Set

Revenues greater than $100 million

Source: Marquette Associates Note: As of December 31, 2023.

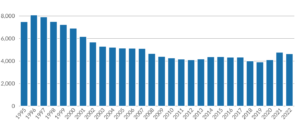

Since 2000, the number of buyout-backed companies has grown significantly, while the number of public companies has declined by roughly 50%.

This dynamic creates more opportunities for private market investors and has created less diversification in public markets.

Source: PitchBook Data, Inc. Note: As of December 31, 2023.

Number of Publicly Traded Companies in the U.S.

Source: World Bank. Note: As of December 31, 2023.

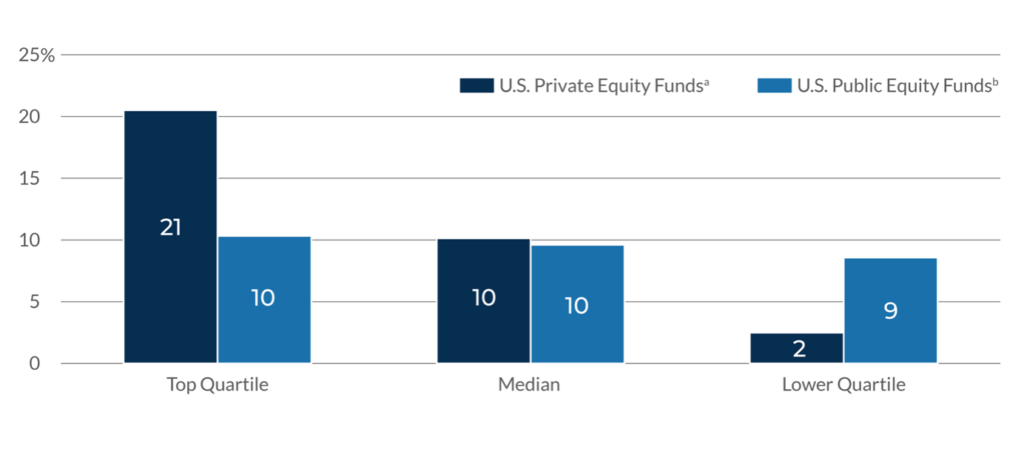

Why Manager Selection Is Critical

Investors in public markets have migrated to more passive (beta) solutions because active management has not proved to be able to consistently or significantly outperform the public benchmark over time.

The opposite is true in the private markets, where high-quality managers have the opportunity and ability to significantly outperform the benchmark and average manager returns. In fact, the data suggests that investors generating average returns in private equity are not much better off than the average returns of public markets.

Pathway believes that being able to identify AND access high-quality managers is the most crucial factor in determining success.

Dispersion between Upper Quartile, Median, and Lower Quartile Managers

Note: IRRs are ranked by quartile. The chart shows the average IRR spread between the first quartile, median, and fourth quartiles for vintage years 1993 to 2023 (i.e., the 25th, 50th, and 75th percentiles), as measured in basis points. Managers may have more than one fund in the sample set, and funds from the same manager may have different quartile rankings.

aMSCI Private Capital Solutions (formerly Burgiss Private i) U.S. all private equity returns, as produced using MSCI Private Capital data. Based on since-inception IRRs, as of March 31, 2024, for funds raised from 1993 through 2023.

bBloomberg. Based on annualized returns for U.S. all public equity funds from 1993 through March 31, 2024.

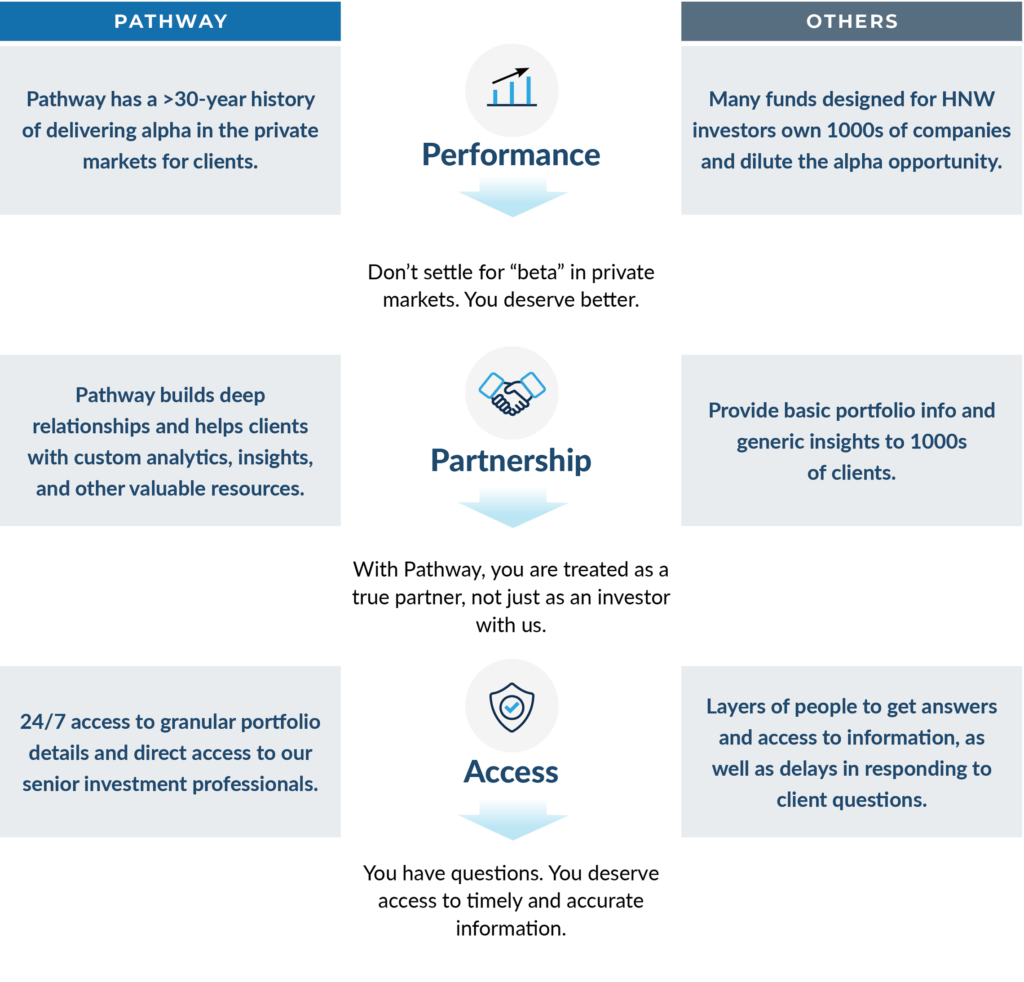

Why Pathway?

For more information, please reach out to invest@pathwaycapital.com.